Access the exclusive world of Alternative Investments

Exceed Capital offers direct access to investment opportunities within the Small Business Finance asset class to retail investors and financial advisors.

Get Start

Get Start

Diversify Your Portfolio

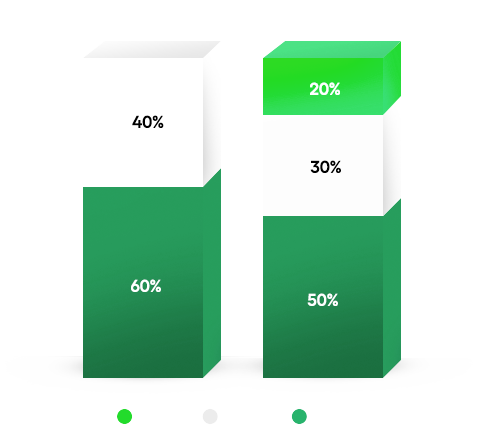

Why alternative investments?

For years, retail investors have heard the 60/40 portfolio has needed to be rebalanced; however,

access to alternatives was limited to the ultra-wealthy and institutions.

In a world marked by volatility and fluctuating yields, a new portfolio is needed.

Adding non-stock market correlated alternative investments to your portfolio can help generate

passive income, boost yield, and add asset diversification.

Invest with Clarity

Our premiere investment experience means you always have access to the full power of Exceed Capital at your fingertips.

Due Diligence conducted by a best-in-class team of professionals

Exceed Capital’s team of investment professionals to review and analyze every investment opportunity offered.

Start building your new age portfolio today

Whether your goal is diversification, generating income, value growth, or a combination of all three, Exceed Capital’s investment offerings can help.

How Exceed Capital Works

Simple and Powerful

Our process combines state of the art technology with an easy to use interface to deliver a simple and powerful investor experience.

Start Investing

Start Investing

Our Approach

Unlocking access to small business financings

Exceed Capital offers direct access to investment opportunities within the Small Business Finance

asset

class to retail and institutional investors inside fixed interest, fixed principal promissory notes.

We’ve bridged a massive gap in the market to create an investment opportunity previously unavailable

on such a broad scale.

Due Diligence

We analyze millions of deals every year so you don’t have to.

Since inception, Exceed Capital has funded over 10 K+ investments representing over $3.5 M in Total MCAs dispersed to end businesses.

Investments

10 K+

Total Money

$3.5 M

Origination

Platform deal offerings undergo a comprehensive underwriting and review process

Exceed Capital partners with originators after performing a detailed underwriting process. The Exceed Capital process takes a methodical and systematic approach in order to admit an originator onto the Exceed Capital platform. Exceed Capital is constantly looking for partners that can enhance the quality of our platform and our investors long term goals.

The process includes but is

not limited to:

Third-Party Assessment; OFAC / CLEAR Report; Site Visit, Financials / Balance Sheet Review

The process includes but is

not limited to:

Underwriting Guidelines; Management & Employee Structure; Review Static Pools; Collection Guidelines / Third Parties Scaled Exposure

The process includes but is

not limited to:

Ongoing Originator Diligence include: Weekly Portfolio Performance Review; Weekly Originator Review; Quarterly Contract Sampling; Semi-Annual On-Site

The process includes but is

not limited to:

Performance monitoring: proprietary AI scoring system provides originator and deal level performance analytics that enhance overall performance via reduction of Funders historical defaults

The Exceed Capital Story

Exceed Capital was founded after we discovered a unique investment opportunity in the world of merchant cash advances.

Start Investing

Start Investing

A New Alternative Investment?

After spending a combined 50+ years in the Merchant Cash Advance space, our founders understood the power of the asset class; however, these investment opportunities were limited to a select few individuals – individuals who had ties to the merchant cash advance industry or larger institutions. Opportunities for retail investors looking to invest in MCA deals were almost entirely inaccessible.

Enter Exceed Capital. We leveraged our expertise to create an investment platform tailored for

investors

eager to access the Merchant Cash Advance (MCA) space. By offering a secure and transparent

platform, we've opened the door to an asset class that was previously inaccessible to individual

investors.

Our platform enables funders to provide capital to small business owners who would otherwise be

turned away due to internal capital constraints. At the same time, it allows accredited investors to

participate in this unique, high-yield asset class.

By bridging the gap between investors, MCA funding companies, and the merchants they serve, we've

effectively lowered the barrier to entry for MCA investing. Through our platform, investors can

access fixed-interest notes with returns ranging from 10-15%, backed by a diversified portfolio of

MCAs with substantial equity surplus to ensure consistent investor payouts.

With a wide range of investment options, varying terms, and flexible interest payment structures,

our platform empowers investors to build a customized portfolio that aligns with their financial

goals.

Exceed Capital Current Note Offerings

36% SV Mid-Term Note - $86,750.00

A mid-term note investing across the broader merchant cash advance spectrum.

Annual Interest Rate

36%

Term

6 Month

Principal Payment

At Term End

Interest Payment

Monthly

39% SV Long-Term Note - $146,850.00

A long-term note investing across the broader merchant cash advance spectrum.

Annual Interest Rate

39%

Term

9 Month

Principal Payment

At Term End

Interest Payment

Monthly

For example, an investor purchasing one $100,000 SV Mid-Term Note would receive monthly interest payment of $2,830 totalling $16,980 over the entire note term. The $100,000 principal is also returned at the end of the 6 month term.

Annualized Rate

Investors are paid an annualized % rate which consists of monthly payments.

3-6 Months

Funds are expected to be repaid in 3-6 months' time.

Rollover

Investors have the option to roll their investment into another note at the date of maturity.

Example Investment:

With a return of 34% per year and the interest is paid and compounded monthly, then the effective

interest rate per month would be approximately 2.83%. To calculate the return on a $100,000

investment in this note, we can use the following formula:

Return = Principal * [(1 + Effective Interest Rate)^n - 1]

where:

The “Principal” is the initial investment amount, which is $100,000 in this case

The ”Effective Interest Rate” is the monthly interest rate, which is approximately 2.83%

n is the number of months the investment is held

If we assume that the investment is held for 6 months, we can calculate the return as follows:

Return = $100,000 * [(1+0.0283)^6-1] = $16,980.00

Therefore, the return on a $100,000 investment in this note would be approximately $16,980.00.

*Note that this calculation assumes that the interest payments are reinvested immediately back into

the principal each month.

**"This example is for illustrative purposes only and is not to be relied upon as investment advice.

There can be no assurance that the investment objective will be achieved

Contact Us Today

To learn more about our merchant cash advance investment platform, contact us today. If you are a discerning accredited investor looking to capitalize on a highly diversified and high yield alternative investment